Ideas are like ferrets to extract value from the market for innovators and Startups. However, the quality of ideas alone does not determine their capability. There are at least seven factors that influence value extraction. Hence, idea management must consider the timing of ideas for systematic ferreting out value from the market.

Ideas are like ferrets for extracting value from the market through product and Process Innovation. To create success stories, we are after ideas. Yes, team capability, risk capital finance, and business model are important for growing and taking ideas to the market. But, what about the timing? Ideas are similar to ferrets to deriving value from the market for the innovators or startups. However, the quality of the ferret alone does not determine the success of catching fish. Like ferrets, ideas are supposed to work in synchronization with other factors for creating innovation success stories. These factors are i. technology, ii. customers’ desperation, iii. infrastructure, iv. competition, v. risk capital, vi. complementary products and vii. Public policy. All these factors are like waves. They grow, mature, and disappear. Hence, the timing of ideas for systematic ferreting out value from the market matters.

The technology life cycle affects the timing of ideas for systematic ferreting

Like many others, Jeff Hawkins had an idea of innovating a personal digital assistant. This idea needed a number of technologies, like display, and stylus. Like Jeff’s one, every idea needs technologies for implementation. Often, it requires multiple of them. A few of them form the technology core of the innovation. The first challenge is to figure out whether needed technologies are there to support the implementation. Is there a possibility that technology cost will outweigh the willingness to pay of target customers for producing profit?

Upon getting yes to these questions, we should look into the state of maturity of technology cores. If they are at a mature stage, the likely possibility of winning with innovation is low. Because mature technology core does not allow in creating the edge by advancing and finetuning for creating aha impression out of perfection. Moreover, mature technology cores do not allow the scope of advancing technologies to release successive better versions. This capability is vital for defending competition. If technology cores are at a mature stage, the competition will reverse engineer and respond with imitation.

For example, Apple needed multitouch technology for implementing the idea of the iPhone. However, Apple did not create the success story by adopting the available mature technology. Although multitouch had the potential to implement Steve’s idea of the user interface without having a keyboard and stylus, it was primitive. Apple took advantage of it. Upon acquiring the premature technology from the outside, Steve’s team embarked on a long journey of advancing and fine-tuning to outperform the competition. Moreover, Apple kept advancing it and releasing successive better versions for sustaining innovation in the competitive market. Similarly, Sony, Toshiba, and Nichia leveraged similar benefits from the technologies that were at the early stage of the life cycle.

State of customers desperation for getting innovations to get jobs done

Customers’ desperation for innovations also starts and grows like an S-curve. Customers should show affinity even for primitive innovations. Along with the idea’s capability to grow, customers’ desperation for having better quality products should also grow. Synchronization between these two waves is vital for ideas to ferret value from the market. For example, IBM came up with the smartphone Simon in 1994. At that time, users were desperate to have mobile phones weighing less and offering longer talk time. Instead of addressing this desperation, IBM came up with a feature-rich smartphone, even weighing more and offering far less talk time.

Hence, IBM failed to develop a profitable business out of Simon. On the contrary, after 12 years, when customers were desperate to use mobile phones to send e-mail, browse the internet, and enjoy music and video, Apple responded with iPhone. Due to a lack of synchronization of IBM’s idea with the customer’s desperation, the idea of a smartphone, Simon failed to ferret value from the market.

Timing of ideas for systematic ferreting must be in sync with the infrastructure

Many ideas need appropriate infrastructure to ferret value. For example, the portable MP3 idea needed high-speed broadband infrastructure to unfold. Due to it, even being late by three years in the game, Apple created iPod success story. The challenge is to be right on time to be in sync with the unfolding of infrastructure. Otherwise, even a great idea fails to extract value. Similarly, Tesla’s electric vehicle has been facing the barrier of charging infrastructure. On the other hand, the lack of adequate hydrogen refueling stations has been a barrier to the rollout of fuel cell vehicles.

The intensity of competition also affects the timing of ideas for systematic ferreting

Like technology, the competition also grows like S-curve. If the state of competition is intense, ideas will face a high barrier. Willingness to pay for the idea will not only depend on the value it delivers but also on the offerings from the competition. Moreover, the value extraction period will depend on the intensity of the competition. The entry strategy with the idea should also take into consideration the state of maturity of the competition.

Availability of risk capital for supporting ideas to grow

If it’s too early, fund managers will not understand the latent potential. It would take an intense effort to communicate the future value of ideas. The appetite for supplying risk capital for a certain type of idea also has a wave-like shape. For example, in the 1990s, fund managers were highly eager to finance .com ideas. However, infrastructure was not ready to support the take-off of those ideas. In the 2020s, AI ideas are highly attractive for getting risk capital funding.

The availability of complementary products affect the timing

Most of the innovations work in partnership with complementary goods and services. For example, the success of YouTube largely depended on the uprising of the mobile phone camera. It’s also vice versa. Similarly, the success of the iPod mostly benefited from the availability of easy-to-download content. To leverage it, Apple had to go for the iTune. Besides, iPhone got a boost with the flow of 3rd party Apps. The availability of a large programmers’ pool also contributed to the supply of those apps.

Public policy also affects the timing of ideas for systematic ferreting

Public policy plays both a supportive as well as an impeding role in the process of letting ideas succeed. For example, policy support for making air cleaner is significantly helping Electric vehicles to proliferate. The growth of renewable energy is also benefiting from public policy. The policy of public funding also influences technology development, infrastructure deployment, and the flow of complementary ideas.

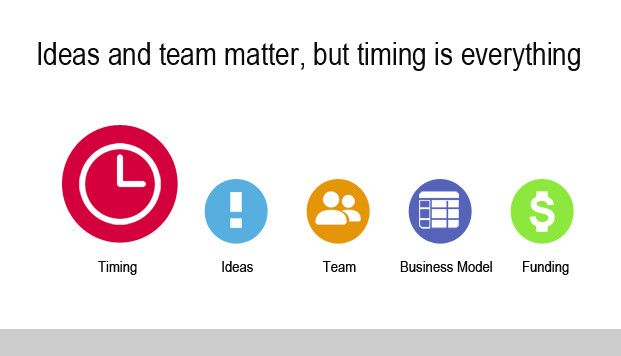

It appears that great ideas alone cannot extract value from the market. A number of factors play both a supportive and impeding role. The nature of the effect depends on the state of maturity. Hence, innovators should look for the right timing of ideas for systematic ferreting. A study of ideaLab finds that timing is the most important factor in determining the startup’s success in taking ideas to market. Timing is followed by the team’s implementation capability, quality of the idea, business model, and funding. Hence, idea management should take into consideration of timing.