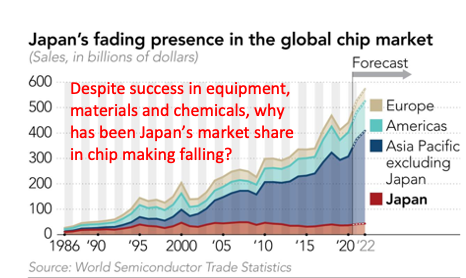

America’s Chip War winning strategy finds strengthening Japan semiconductor manufacturing a key component. Despite maintaining supremacy over 30 years, Japan’s market share has fallen from fifty percent in the 1980s to a meager 9 percent in 2022. However, there is a sharp contrast between the reasons for which Japan attained the global top position and the approach being touted to regain it partly. Hence, Japan’s semiconductor revival strategy raises a fundamental question. Will the massive subsidies, the USA’s strategic support, international collaboration, and political will to reduce reliance on external suppliers like China succeed? The subsequent questions are: how did Japan build the semiconductor industry, attain the top position, and lose it?

Key takeaways of Japan semiconductor industry

- Semiconductors in Japan–the rise of Japan’s modern industrial economy is due to the success of the refinement of semiconductors and leveraging it for Reinvention and Incremental Innovation of various products, resulting in a growing deep root of semiconductors in Japan.

- Past and present of Japan’s semiconductor industry–due to refinement success and leveraging semiconductors for reinvention and incremental innovation, Japan became the largest producer of semiconductor devices in 1956 and retained that position till 1986. However, the steady decline of Japan’s semiconductor market share from above 50% in 1986 has led to 9 percent in 2022. Despite shrinking market share in semiconductor manufacturing, Japan’s semiconductor industry has a strong position in equipment, chemicals, wafers, and supplies.

- Japanese semiconductor companies–notable Japanese semiconductor companies are Toshiba, Sony, Tokyo Electron, Canon, Jeol, Sumco, and many more. Many Japanese companies have monopolistic market positions in specialized equipment and chemicals for semiconductor manufacturing.

- Recent programs to revive Japan’s semiconductor Industry–US’s strategic support, partnership with IBM and IMEC for 2-nm process nodes, establishment of RAPIDUS, and establishment of high-end research facilities are notable initiatives for reviving Japan’s semiconductor industry.

- Likely missing building blocks to revive Japan’s semiconductor industry glory–unlike the past, Japan misses riding major reinvention waves demanding a new Flow of Ideas for process refinement and microchip innovations. Worth noting that Intel and TSMC rose due to riding personal computer and smartphone waves, respectively.

The consumer electronics reinvention wave created Japan semiconductor industry

In retrospect, the semiconductor epicenter tends to migrate. It happens due to the rise of new waves of innovations. For example, within ten years of the invention of the Transistor by the USA’s Bell Labs, Japan became the largest producer of semiconductor components. It occurred because American firms like RCA, TI, and others shied away from reinventing consumer electronics products like Radio and TV, while Sony-led Japan found it an opportunity.

Similar to many other inventions, semiconductors like transistors and diodes started the journey as primitive and expensive devices. Hence, they were not readily suitable for replacing vacuum tubes in reinventing consumer electronics products. Therefore, established American and European firms shied away. Instead, they pursued the defense market of transistors to profit from reducing onboard computers’ weight by replacing vacuum tube switches with transistors. Unfortunately, Japanese firms did not have access to the military market. Hence, they focused on consumer electronics to leverage the possibility of semiconductor technology.

To fuel the reinvention waves of Radio, TV, and many other consumer products, Sony and other Japanese companies vigorously pursued the refinement of semiconductor devices. Consequentially, although reinvented Japanese consumer electronics products were initially inferior, they started getting better and cheaper due to refinement. This refinement approach created a virtuous cycle of profiting from semiconductor advancement fueling consumer products’ reinventions. Hence, along with the rise of Japan’s consumer electronics reinvention waves, unleashing Disruptive innovation effects on American and European counterparts, Japan semiconductor industry started accelerated growth. Consequentially, Japan attained the global top position in semiconductor manufacturing.

Such a reality raises a critical question. What could have been the fate of Japan Semiconductor industry if American and European companies had not left the reinvention opportunity of consumer electronics to Sony and others?

Current state of Japan semiconductor–strength across the value chain

The fall of Japan semiconductor manufacturing edge is not limited to sliding from 50 percent to 9 percent in global market share. Its best-performing fab operates at 40nm node, about ten years behind world leaders TSMC and Samsung. The profit-making opportunity in upgrading process nodes for consumer electronics and the DRAM market is already saturated. Hence, Japan semiconductor finds older nodes good enough to make money in NAND memory, power semiconductors, microcontrollers, and CMOS image sensors.

Ironically, unlike China, Japan does not face barriers to technology and human capital for upgrading process nodes, reaching TSMC’s level. Surprisingly, foundry leaders like TSMC and Samsung rely on Japanese high-precision equipment, chemicals, gas, and wafers for their latest nodes.

Japan semiconductor industry established roots in key manufacturing inputs and equipment to support the refinement journey. Notable successes include wafers, chemicals, gases, process and test equipment, and lithography. For example, Tokyo Electron, Advantest, Nikon, Canon, SUMCO, and Shin-Etsu provide essential global semiconductor industry building blocks. High-end expertise of Japanese semiconductors is in the following links of the global value chain of semiconductors:

Lithography—Nikon and Cannon have a strong position in the DUV lithography market. Japan also supplies critical components for EUV lithography to operate. Besides, Canon recently launched nanoimprint lithography for the 5nm node with the indication of moving towards 2nm. Apart from this, Tokyo Electron (TEL) has a global monopoly in in-line coaters/developers for EUV.

Chip stacking—through close R&D partnership with IBM and Albany Colleges of Nanoscale Science and Engineering (CNSE) in Albany, New York, TEL has a strong position in chip staking equipment. Perhaps TEL will develop the world’s first chip stacking operations on 300 mm wafers.

Photomasks—Japanese JEOL and NuFlare are not as well known as ASML for EUV lithography powering sub-10nm process nodes. However, these two Japanese companies have a 91 percent share of the global market for EUV lithography mask-making.

Resist processing—As high as 96 percent of the global market of resist processing equipment market belongs to two Japanese firms—TEL and SCREEN.

High-end photoresist—four Japanese companies have a combined market share of 75 percent in high-end photoresist for advanced chipmaking. These companies are Shin-Etsu Chemical, Tokyo Ohka Kogyo, JSR, and Fujifilm Electronic Materials. They have a near monopoly position on the photoresist needed to enable EUV lithography to produce fine features at sub-10nm nodes.

Wafer crystal machining and wafer handling—In the global equipment market for wafer crystal machining, 95 percent market share belongs to Japanese firms Accretech, Okimoto, Toyo, and Disco. Besides, 88 percent share of the global market for wafer handling equipment is under the control of Rorze, Daifuku, and Muratech.

Semiconductor materials—Japanese companies use as many as 50 percent of global supplies of 14 of the most critical materials needed for chipmaking, including photomasks, photoresists, and silicon wafers.

3D chip packaging—Nissan Chemical and Showa Denko–Japanese semiconductor materials suppliers—are in the lead in developing and producing materials needed for 3D chip packaging.

Silicon Wafers—In the global wafer market, SUMCO and Shin-Etsu Chemical together hold a 60 percent share.

Despite all these strengths, why has Japan remained far behind TSMC or Samsung in operating high-end fabs? The answer is simple. This is about a lack of profit-making opportunity—which does not suddenly grow. Of course, subsidies may create an entry. But, profiting from it demands riding a rising wave offering profit-making revenue from continued upgrading process nodes in reducing feature size.

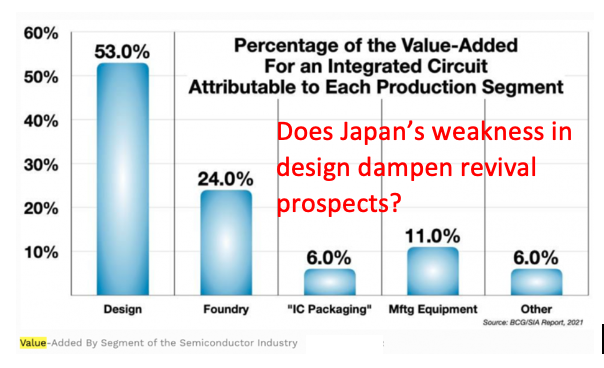

Japan’s weakening base in design and innovations creates the demand for semiconductor

Although Japan has substantial strength in semiconductor equipment and materials, its contributions to the overall value chain are not very high. For example, semiconductor equipment contributes only 11 percent of value added of $600 billion industry.

The main contribution to the global semiconductor industry is the design, creating value from knowledge and ideas. As high as 53 percent value distills from this segment. In addition to knowledge of how to design microchips using the EDA tools, ideas play a vital role. These ideas belong to what features to be integrated into microchips. They keep following the lead of evolving target products like smartphones, smart televisions, washing machines, or wearable devices. For example, Taiwan’s microchip design industry’s success in creating around $40 billion value through as low as 54,000 microchip designers has been due to it. One notable example is MediaTek’s success in smartphone processor innovation, like Dimensity and Helio processor series. Similarly, fabless companies like Apple, Broadcom, and Nvidia have been leveraging high value from ideas.

The top ten fabless semiconductor companies in 2022 generated more than $150 billion in revenue. Unfortunately, although Japanese companies dominate the top 10 list of semiconductor equipment and materials, there is no single Japanese company among the top 10 fabless ones. Ironically, Japan’s semiconductor success started to form due to ideas of reinvention of consumer electronics. Unfortunately, over the last 50 years, Japan could not scale it up as the powerhouse of fabless companies driving reinvention waves. Such a reality weakens the strategy of reviving Japanese semiconductors.

Lesson from the rise and fall of the US and the rise of Taiwan in semiconductor

Compared to vacuum tubes, in the 1950s, transistors were far more expensive and less performing. For example, Fairchild’s first batch of semiconductors in 1956 was priced at $150 apiece. Besides, due to high noise and low power handling capacity, the sound and picture quality of radios and TVs made from transistors was very poor. Hence, American and European companies, having a solid foothold in consumer electronics products, were reluctant to reinvent them by replacing vacuum tubes with transistors.

However, due to the weight advantage, the US-led Western military showed interest in paying a premium price to reinvent the computer modules for bombers, missiles, and satellites. Hence, the US semiconductor industry around Fairchild and Texas Instruments started to form to serve the military market. Japanese companies did not have the option to serve the military market, so they focused on refining semiconductor devices and production processes for fueling consumer electronics reinvention waves. Hence, two nodes started forming: one in the USA and another in Japan. As the consumer electronics reinvention wave was far more significant than the military market, Japan reached the top and remained in that position till 1986. Hence, this history shows that the reinvention wave serving the civilian market is far more powerful than the USA’s policy and military agenda.

However, in the early 1980s, the US applied punitive tariffs against the Japanese semiconductor industry to snatch away supremacy from Japan. The USA also offered subsidies to its semiconductor firms through SEMATECH. Unfortunately, it did not work as expected. However, this Government initiative coincided with the selection of Intel’s microprocessors (8088) by IBM in developing PCs. Consequentially, the rise of the PC wave led to sharpening America’s silicon edge, taking it to the top.

USA lost the semiconductor edge due to missing new waves

Unfortunately, the USA could not stay at the top due to avoiding or failing to ride two major waves—(i) 3rd party foundry model and (ii) smartphone. As Samsung, followed by TSMC, were at the forefront in these two waves, they rose to the peak. Lately, Apple’s affinity for remaining with TSMC for producing its latest A-series chips led to the rise of TSMC as the only fab operating at the latest node.

Military market no longer demands high-end process nodes

The rise of the USA’s semiconductor industry in the 1960s has been primarily due to the demand of the military market. More than half of the microchips produced in the 1960s went for powering onboard computers of the US military. As miniaturization reduced the weight and power requirement, the US military had a high appetite to pay more for the following generation process nodes. Hence, the USA semiconductor industry found it a highly profitable opportunity for semiconductor R&D to increase chip density, creating Moore’s law.

However, the US and the global military market do not find economics in further miniaturization of microchips to meet the mission need. Further weight and energy reduction do not save enough money to pay more for the microchips produced by the next node. Hence, almost all microchips used in weapons are legacy chips produced through older process nodes. Therefore, it’s no surprise that TSMC’s major clients do not make chips for the military market.

The consumer electronics market is the largest customer, notably iPhone and other high-end smartphones. For example, the primary customer of TSMC’s 3nm process node is Apple’s A17 processor. High-end smartphone makers find migration to the next process node profitable due to consumers’ willingness to pay for energy-saving higher-performing processors. Similarly, large data center operators or cloud platforms are willing to pay more for the microchips produced by the next node, as it reduces energy bills. For the same reason, crypto firms were after NVidia’s GPU manufactured by the latest process node.

Next wave for powering Japan semiconductor manufacturing

There has been a common belief that overcoming the hurdle of moving to the next process node faster than competitors is good enough to regain the glory of Japan’s semiconductor industry. Of course, that is a challenge. However, finding customers to pay more for chips produced using the latest node is far more challenging to profit from it. In retrospect, TSMC’s rise has resulted from fueling smartphone, data center, and crypto firm waves.

Moving to the next node tends to increase the cost. For example, Apple’s cost of producing an A17 chip (containing 19 billion transistors) using a 3nm process node appears to be $150, far more than A16’s (containing 16 billion transistors) $108 produced using a 4nm node. As the military has lost the appetite for the latest node, profiting from process node migration must find innovation waves for serving the civilian market. Due to such a reality, regaining semiconductor edge by migrating to the latest process node demands the next innovation wave. Where is that one for the Japan semiconductor industry?

US blessing, subsidies, and collaboration—are they good enough?

Amid post-WWII restrictions and devastated infrastructure, Japan built the semiconductor industry from scratch in the 1950s. Sony had to take special permission to pay only $25,000 licensing fees to Bell Labs. Ironically, during good times, Japan lost its top semiconductor manufacturing position. Initially, it lost the edge to the US due to the PC wave. Subsequently, it kept losing market share because TSMC and Samsung succeeded in gaining market share for fueling the smartphone waves. In retrospect, whatever the edge that Japan has is due to NAND flash memory and image sensor advancement. Japanese firms like Toshiba and Sony created both of these.

Of course, the US blessing, partnership with IBM and IMEC for a 2nm process node, and subsidies to Rapidus will enhance Japan’s process node uplifting. But where is the market for Japan’s 2nm process node? What are the subsequent innovation waves Japan’s semiconductor industry will fuel to generate profitable revenue? Ironically, older process nodes are good enough for Denso and other automobile companies participating in the Rapidus project.

Of course, offering as high as 30% capital expenditure subsidies to TSMC will expand semiconductor production in Japan. But will it be a profitable operation for Japan? What is the additional value TSMC will source from Japan to outweigh the subsidies? Of course, Japan may find cost reduction means by establishing new testing and packaging nodes in South Asia.

Hence, unless Japan finds new Waves of Innovation demanding further miniaturization of microchips, moving to the latest node alone will not likely revive Japan semiconductor manufacturing industry.

Related Articles:

- Chip War

- Chiplet Technology — a weak reinvention core?

- Semiconductor Economics–will Chiplet era slow down the growth?

- ASML–growing pearl gets caught in Chip War

- China’s Semiconductor Independence–prematurely caught?

- India’s Semiconductor Dream–pushed in the slow lane?

- Semiconductor Value Chain–globally distributed ecosystem

- Semiconductor IndustryWaves

- Intel Falling Due to PC and Mobile Waves

- ASML Lithography Monopoly from Sustaining Innovation

- Taiwan’s Semiconductor Monopoly – How did it arise?

- ASML TSMC Nexus Fuels Semiconductor Monopoly

- ASML Monopoly in Semiconductor — where is magic?

- SEMICONDUCTOR MONOPOLY DUE TO WINNING RACE OF IDEAS

- Semiconductor Industry Growth–personalities, new waves, and specialization underpin

- Transistor–technology core shaping global trade and power

- Loss of America’s Inventions–blame semiconductor economics?

3 comments

Rather valuable piece

This is a well-written and well-structured article that provides valuable insights into the current state of Japan’s semiconductor industry. The depth of analysis on the challenges and innovations driving the sector forward is both informative and engaging. It has certainly helped us gain a clearer understanding of the industry’s evolving landscape and the key factors influencing its future. Great work!